Spend category highlight: Payment processing

Having the ability to take card payments, whether online or in bricks and mortar locations, is an important solution for any transactional business. Get it wrong and you will see dropped baskets, higher decline rates, and a negative impact on your turnover. However, when payment processing is done correctly, you could increase your authorisation rate by 5% and ensure happy, returning customers.

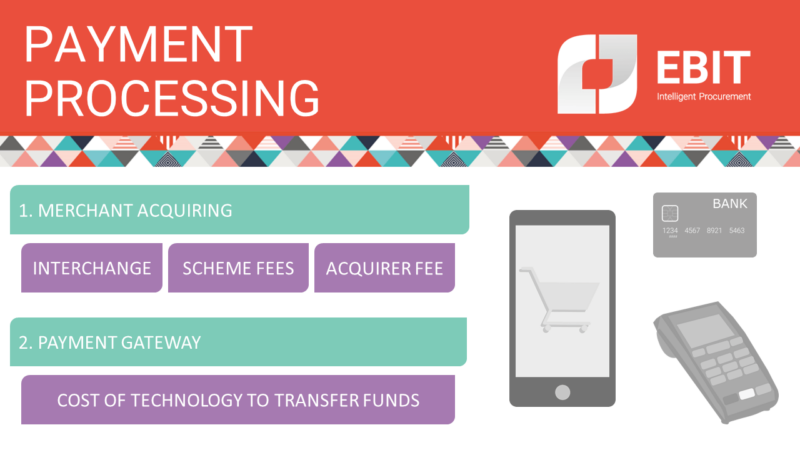

Payment services are made up of a number of areas, but fall into two main categories;

- Merchant Acquiring: The process by which money is issued from the customer’s bank to yours. Your merchant acquiring cost is made up of three elements:

- Interchange: This is set by the payments network and fluctuates depending on whether the card payment is made by debit or credit, if it’s international, if it’s a corporate payment, etc.

- Scheme fees: These are set by the schemes themselves, and again fluctuate depending on which scheme.

- Acquirer fee: This is the margin your acquirer takes and is the only element of merchant acquiring that is negotiable.

- Payment Gateway: The cost of the technology that enables the transfer of funds. This is a negotiable cost.

Things to consider

When you look at payments as a service, it is important to understand your customers and their payment habits. Are you offering local payment methods for international customers? Are they interested in delayed payment methods? Are they expecting certain solutions such as AmazonPay, or Paypal? One of the ways you can understand your customer’s expectations is from the data that tokenisation can bring; by capturing card details online and connecting them to store purchases, you build a robust view of your customer’s spending habits. Not only does this mean you can personalise loyalty and reward schemes, driving further business (for example, discount codes via email after a customer’s 10th consecutive order, or prompts to a customer that hasn’t visited for a while), but this data can be compared with other similar retailers that your payment partner services. These reports can help you understand what drives your customer to spend outside of your own business and can give you the opportunity to improve your solution to match.

Payment services is an ever-changing landscape with new solutions, processes, and technologies evolving continuously. It is vital that your business is not only on top of these changes, but able to offer the most relevant solutions to ensure payment authorisation. 3DS 2.2 is the newest version of payment security and comes with an increased chance of your customer abandoning their basket once they get to this point. However, quick thinking payment partners have developed exemption engines, which make certain checks against each payment card to determine if it’s secure enough to bypass the 3DS route and therefore increase your authorisation rate.

In order to achieve total governance of your payments area, you need to ensure you have the right payments partner; one that is agile, can pivot to your needs, and be ahead of the curve to drive change. Running a tender process every few years is a good way to actively identify new drivers and challenge your current solution. Involving multiple departments from your business in the tender process, such as IT, customer experience, finance and ecom, will help to ensure a wider view is taken and a well rounded solution is considered.

Get in touch to find out how Ebit can help your business with payment processing.